Beware of the Spread

Talking Points:

-What Is the Spread?

-Spread Focal Points That FX Traders Should Regard

-How a Wider Spread Can Eat Into Your Account Equity

“Price is what you pay. Value is what you get.”

Warren Buffett.

What Is the Spread?

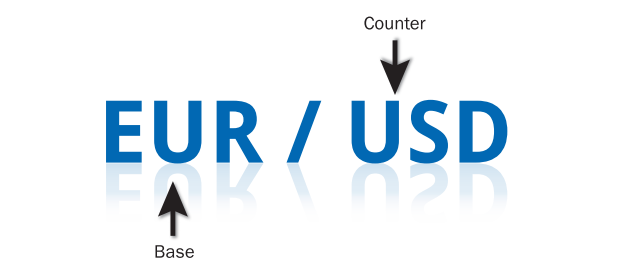

Forex trading is a very cost-effective market relative to other markets. As a trader in the FX market, your only cost to enter a trade is the spread. The spread is measured in pips and is the difference between the bid and ask of two currencies that are known as the base and counter currency.

If you’re actively trading, you should care very much about how many pips make up the spread on the trade you’re considering. Your concern would focus on the fact that you’ll be paying the spread every time you enter into the trade and the less spread you pay, the quicker your trade will be profitable if the market moves in the direction you anticipated. Please note that you do not pay the spread when exiting the trade.

If you’re unfamiliar with the term pips , there is no need to remain confused. Chances are, you’ve heard the broadcaster on the financial news network mention that the stock market was up or down 100 “points” today or that Oil was down a handful “ticks”. The forex equivalent of points or ticks is pips and for a majority of currencies, the pip is found in the fourth spot past the decimal, but you have paris such as those with the Japanese Yen where the pip is found in the second spot past the decimal.

Spread Focal Points That FX Traders Should Regard

If you hold the trade for a longer period of time than a scalper would (multiple hours, days, or weeks) then the spread only become of interest to you upon entry as well as times of relative illiquidity. To think in terms of liquidity, its best to think as to when banks are less aggressive in offering prices on the markets. Banks are often least aggressive at times of uncertainty or when the multiple banks are scaling back on their price offerings like on major news events or on the close of the market or open of the market.

Learn Forex: Bid / Ask Travel Nearly in Tandem At Most Times except Thin Markets like EMFX

Presented by Tyler Yell

If you like to trade emerging market currencies, or have thought about doing so, you’ll notice the spreads are above average. Not only are the spreads larger but the moves are often quicker than most currencies on a total pip move basis. When you look at the driving force of Emerging Markets, you should be aware of more aggressive moves which can be caused by monetary policy divergence. This is common under such EMFX crosses like USDZAR, (US DOLLAR / South African Rand) or USDMXN, (US Dollar / Mexican Peso) or a Central Bank announcement resulting in a flow of capital out of the less developed / stable economies, which make risk: reward all the more important. However, there are two key things that you should focus on in terms of the spread; pip cost and spreads widening at illiquid moments in the market.

You’ve recently learned how spreads can cause margin calls especially when traders become over-leveraged and try to engage a hedge. However, if you’re not careful, the EMFX crosses and even thinner G10 crosses can eat into your account equity regardless of attempted hedge towards thinner times of the market, like the daily close and definitely the weekly close on Friday at 5pm ET. In crosses like USDMXN or even GBPNZD, you can easily see spreads of 30-250 pips.

Before we move on to the next section, please understand that not all spreads are created equal. The pip cost or value will determine if a 2 pip spread is equivalent to a 20 pip spread from a cost perspective or maybe even cheaper. On USDMXN, you can see a 100k trade brings a pip value of $0.75, so a 20 pip spread would only be $15. Whereas a 2 pip spread on EURUSD with a $10 per pip value per 100k lot would be more expensive at a net cost of $2.

How a Wider Spread Can Eat Into Your Account Equity

The significance of a widening spread, like the one shown on both tick charts, is due to a fact that no trader can deny. If you hit the bid, and are now long the currency pair like GBPUSD, you should only care about the offer because the level at which you can get out of the trade will determine your loss or profit. When in a trade, a widening spread means that a profitable exit is less likely or the amount of profitably is diminished.

Bottom Line:

The core of this article is to help you see how a wider spread can eat into your account equity beyond what you may first expect. If you are in an active trade, the only thing that matters is getting out at the best price according to your analysis and a smaller net-spread can help immensely. Therefore, as an educated and active Forex trader, beware of the spread.

Hi Sham

Hi Sham