What Is a Margin Call & How Do You Avoid One?

Talking Points:

-A Short Introduction to Margin & Leverage

-Causes of Margin Calls

-Margin Call Procedure

-How to Avoid Margin Calls

“Never meet a margin call. You are on the wrong side of a market. Why send good money after bad? Keep the money for another day.”

-Jesse Livermore

To get a grasp on what a margin call is, you should understand the purpose and use of Margin & Leverage. Margin & Leverage are two sides of the same coin. The purpose of either is to help you control a contract larger than your account balance. Simply put, margin is the amount required to hold the trade open. Leverage is the multiple of exposure to account equity.

Therefore, if you have an account with a value of $10,000 but you would like to buy a 100,000 contract for EURUSD, you would be required to put up $800 for margin in an UK account leaving $9,200 in usable margin. Usable Margin should be seen as a safety net and you should protect your usable margin at all costs.

Causes of a Margin Call

To understand the cause of a margin call is the first step. The second and more beneficial step is learning understanding how to stay far away from a potential margin call. The short answer as to understand what causes a margin call is simple, you’ve run out of usable margin.

Learn Forex: Usable Margin & Usable Margin % Are Key Metrics of Every Account

The second and promised more beneficial step is to understand what depletes your usable margin and stay away from those activities. In risk of oversimplifying the causes, here are the top causes for margin calls which you should avoid like the plague (presented in no specific order):

- Holding on to a losing trade too long which depletes Usable Margin

- Overleveraging your account combined with the 1st reason

- An underfunded account which will force you to over trade with too little usable margin

Put together in one sentence, the common causes of margin call is the use of excessive leverage with inadequate capital while holding on to losing trades for too long when they should have been cut.

What Happens When A Margin Call Takes Place?

When a margin call takes place, you are liquidated or closed out of your trades. The purpose is two-fold: you no longer have the money in your account to hold the losing positions and the broker is now on the line for your losses which is equally bad for the broker.

How to Avoid Margin Calls

Leverage is often and fittingly referred to as a double-edged sword. The purpose of that statement is that the larger leverage you use to hold a trade greater than some large multiple of your account, the less usable margin you have to absorb any losses. The sword only cuts deeper if an over-leveraged trade goes against you as the gains can quickly deplete your account and when your usable margin % hits, zero, you will receive a margin call. This only gives further credence to the reason of using protective stops while cutting your losses as short as possible.

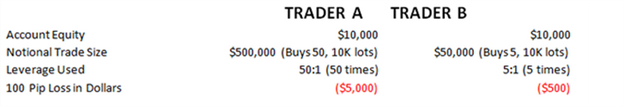

Learn Forex: The Effects of Leverage Cut Both Ways, Choose Wisely

The purpose of this quick Trader A vs. Trader B snapshot is to show you the quick peril you can find yourself in when over leveraged. In the end, we don’t know what tomorrow will bring in terms of price action even when a compelling set-up is presented.

Happy Trading!

Hi Sham

Hi Sham