What is PIP?

When trading a mini lot (10k units of currency), each pip is worth roughly one unit of the currency in which your account is denominated. If your account is denominated in USD for example, each pip (depending on the currency pair) is worth about $1.

In all pairs involving the Japanese Yen (JPY), a pip is the 1/100th place -- 2 places to the right of the decimal. In all other currency pairs, a pip is the 1/10,000 the place -- 4 places to the right of the decimal.

(Created by Jeremy Wagner)

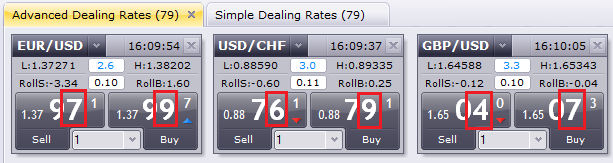

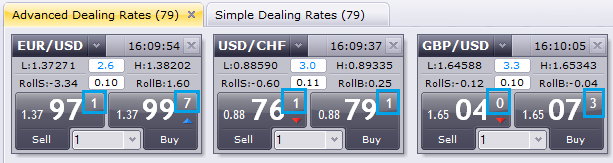

You’ll see that the digits for pips are in a larger font. This makes them easier to see.

Additional transparency is provided through most electronic platforms as each currency pair is quoted with precision to 1/10th of a pip. This fraction of a pip allows price providers to bring spreads down even further as they are not restricted to quoting in full pip increments. This is beneficial to you, the trader, because the spread is a component of your transaction cost.

You’ll notice that earlier in this post, we mentioned that the value of a pip for a 10,000 unit trade is roughly equal to 1 unit of your denominated currency (or $1 if you have a USD account).

Now, let’s identify what the actual value per pip is.

For those who wish to determine the calculation by hand, follow this method below (if you are not interested in the mathematics involved, then proceed to the next article).

First you start with the size of your trade. If you want the value of a pip for a mini lot, you start with 10,000. You then multiply your trade size by one pip for the pair that you are trading.

In this example we are going to calculate the value of a pip for one 10k lot of EUR/USD.

So since I am using 10k mini-lot, I’m starting with 10,000. I multiply 10,000 by .0001 since 1/10,000th is a pip for all pairs (except JPY pairs).

That gets me a value of 1. That will be valued in the “counter currency” (second currency) of the pair that I am trading. In this example, I am trading EUR/USD, so USD is the counter currency of the pair. One pip is worth 1 USD dollar for one 10k lot of EUR/USD.

If my trading account is based in US Dollars, then I will see $1 of profit or loss on my account for every 1 pip move that the EUR/USD makes in the market.

Now, if my trading account is based in Euros (EUR), I would have to convert that $1 USD into Euros. To do so, I just divide by the current EUR/USD exchange rate which at the time of writing is 1.3797. I’m dividing here because a Euro is worth more than a USD, so I know my answer should be less than 1. 1 divided by 1.3797 is 0.7248 Euros. So now I know that if I have a Euro based account, and profit or lose one pip on 1 10k lot of EUR/USD, I will earn or lose 0.7248 Euros.

Let’s do another example of GBP/JPY

Again we’ll go with a one 10k lot trade.

This time a pip is .01 because it is a JPY pair.

10,000 times .01 is 100. Again, that “100” is in terms of the counter currency, so it is 100 Japanese Yen (JPY).

Now we need to convert that 100 Yen to the denomination of your account. If you have a USD based account, then you take the 100 Yen and divide it by the USD/JPY, spot rate, which at the time of this writing was 105.11. That gets you an answer of $0.95 per pip.

Hi Sham

Hi Sham