Forex Vs Other Markets

Talking Points:

- Forex provides many advantages over traditional markets

- The Forex market estimates over $4 Trillion in daily volume

- Costs and market access make Forex accessible virtually around the clock

The foreign exchange market, also known as Forex, has unique characteristics that set it apart from traditional equities and futures markets. The good news is these differences provide many advantages that traders can benefit from on a day to day basis.

So today we are going to look at how Forex stands apart from other markets

Volume

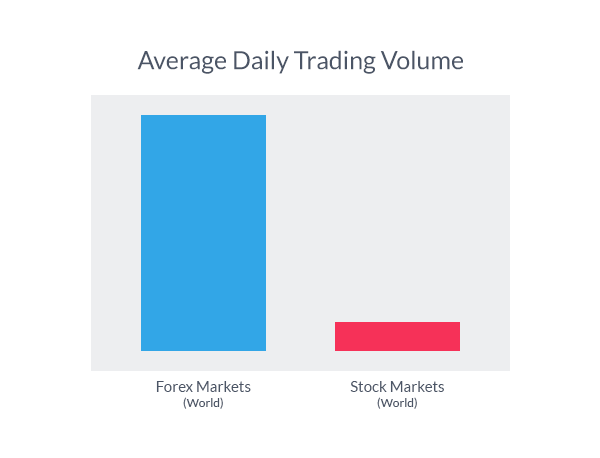

The first difference between Forex and other markets is the sheer size of the Forex market. Forex is estimated to be a $4 trillion a day market, with most trading concentrated on a few major pairs. This dwarfs the dollar per dollar volume of all of the world’s stock markets combined average only about $84 billion per day.

Having such a large daily trading volume can bring many advantages to traders. Primarily added volume allows traders to receive execution. While all markets are prone to gaps, having more liquidity at each pricing point better equips traders to enter and exit the market rapidly when it counts!

24 Hour Markets

Forex is an over the counter market meaning that it is not transacted over a traditional exchange. Trading is facilitated through the interbank market. This means trading can go on all around the world during different countries business hours and trading sessions. Therefore the Forex trader has access to trading virtually 24 hours a day 5 1/2 days a week!

The Forex market also has no restrictions on trading. This means you can enter, exit, or modify a trade at your convenience. This is vastly different from trading a futures or equities contract on a regional exchange where markets only have limited availability for a small portion of the day. In short, Forex trading allows you to trade the strategy that you want, when you want!

Costs

Most Forex accounts trade without commission, and there are no expensive fees or data licenses. The cost of trading is the spread between the buy and sell price, which is always clearly displayed on your screen. This is quite different than trading other markets. When trading equities or a futures contract, you often have to pay the spread along with a commission to a broker while not including a data charge for a price stream and charting!

While you may not see the costs of trading other contracts,Forex spreads are always transparent. Below you will see the spread of the EURUSD ,highlighted inside of the executable dealing rates. This way you can calculate the cost for your position size upfront prior to execution!

Trading Decisions

Lastly it is worth mentioning that Forex trading revolves around 8 major currencies. This keeps the time of analysis low when you are looking for a trade! This is one area where more is not necessarily better. Consider that there are over 1867 companies listed on the NYSE (New York Stock Exchange). Even if you have a fundamental opinion of the market, this can complicate the task of honing in on just one stock to trade.

Hi Sham

Hi Sham